Securing Success: Bagley Risk Management Solutions

Securing Success: Bagley Risk Management Solutions

Blog Article

Recognizing Livestock Threat Protection (LRP) Insurance Policy: A Comprehensive Guide

Navigating the realm of livestock risk protection (LRP) insurance policy can be a complicated undertaking for numerous in the farming industry. This sort of insurance coverage offers a security net versus market fluctuations and unpredicted situations that can affect animals producers. By recognizing the ins and outs of LRP insurance policy, manufacturers can make enlightened decisions that may safeguard their operations from monetary dangers. From just how LRP insurance works to the numerous coverage options offered, there is much to discover in this extensive overview that can potentially shape the way animals manufacturers come close to threat management in their organizations.

Just How LRP Insurance Policy Functions

Occasionally, comprehending the technicians of Animals Danger Defense (LRP) insurance can be complex, yet breaking down how it works can provide clarity for breeders and farmers. LRP insurance is a danger monitoring tool created to secure animals manufacturers versus unforeseen cost decreases. It's crucial to keep in mind that LRP insurance coverage is not an earnings guarantee; rather, it concentrates entirely on price risk protection.

Qualification and Protection Options

When it comes to insurance coverage alternatives, LRP insurance policy supplies manufacturers the adaptability to select the coverage degree, insurance coverage duration, and recommendations that finest fit their risk administration needs. By understanding the qualification standards and protection alternatives readily available, animals producers can make enlightened decisions to take care of threat successfully.

Advantages And Disadvantages of LRP Insurance Coverage

When examining Livestock Threat Security (LRP) insurance coverage, it is necessary for livestock manufacturers to consider the benefits and drawbacks intrinsic in this risk monitoring tool.

One of the primary benefits of LRP insurance coverage is its capacity to offer defense against a decline in livestock costs. This can help protect producers from monetary losses arising from market fluctuations. Furthermore, LRP insurance policy supplies a level of flexibility, enabling manufacturers to customize protection levels and policy periods to match their details demands. By locking in an ensured cost for their livestock, manufacturers can much better take care of threat and prepare for the future.

Nonetheless, there are additionally some downsides to consider. One limitation of LRP insurance is that it does not secure against all kinds of risks, such as disease outbreaks or natural disasters. Costs can often be expensive, especially for producers with large animals herds. It is critical for manufacturers to thoroughly examine their specific danger direct exposure and economic circumstance to determine if LRP insurance is the appropriate danger management device for their procedure.

Comprehending LRP Insurance Premiums

Tips for Taking Full Advantage Of LRP Conveniences

Taking full advantage of the advantages of Animals Danger Protection (LRP) insurance policy requires strategic preparation and aggressive threat management - Bagley Risk Management. To take advantage of your LRP insurance coverage, take into consideration the following tips:

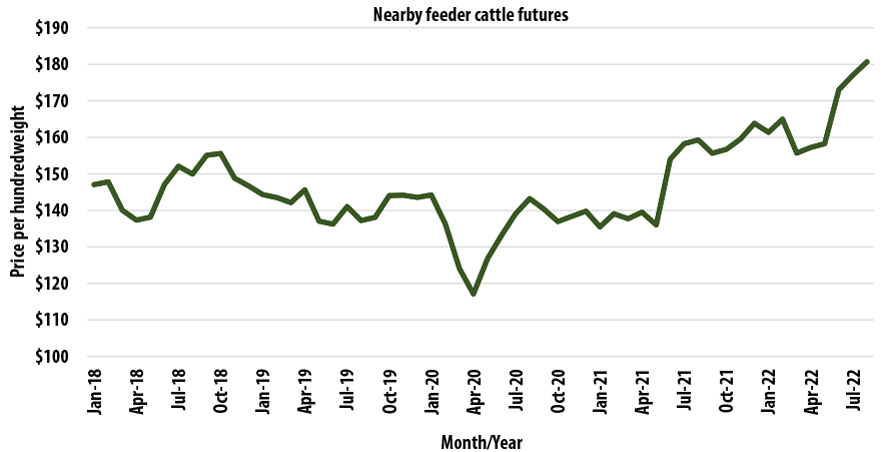

Regularly Evaluate Market Problems: Keep educated about market fads and rate variations in the livestock industry. By keeping an eye on these elements, you can make enlightened choices concerning when to acquire LRP protection to shield versus possible losses.

Set Realistic Protection Degrees: When choosing insurance coverage degrees, consider your production costs, market price of livestock, and possible dangers - Bagley Risk Management. Establishing sensible protection degrees makes sure that you are adequately protected without paying too much for unneeded insurance

Diversify Your Coverage: Instead of depending entirely on LRP insurance policy, take into consideration expanding your risk management methods. Incorporating LRP with other danger monitoring tools such as futures contracts or alternatives can offer extensive protection against market unpredictabilities.

Testimonial and Change Protection On a regular basis: As market conditions alter, regularly examine your LRP coverage to guarantee it straightens with your current threat exposure. Changing protection levels and timing of acquisitions can aid maximize your threat defense method. By following these suggestions, you can make the most of the advantages of LRP insurance coverage and protect your animals operation against unanticipated threats.

Conclusion

In conclusion, livestock risk protection (LRP) insurance blog policy is a valuable device for farmers to manage the monetary threats connected with their animals procedures. By understanding exactly how LRP works, qualification and coverage options, along with the advantages and disadvantages of this insurance, farmers can make informed decisions to shield their resources. By meticulously thinking about LRP costs and carrying out see post methods to make the most of benefits, farmers can alleviate potential losses and make certain the sustainability of their procedures.

Animals manufacturers interested in getting Animals Danger Defense (LRP) insurance coverage can check out a range of qualification requirements and insurance coverage choices tailored to their specific animals operations.When it comes to coverage options, LRP insurance coverage provides producers the he said adaptability to pick the protection degree, protection duration, and recommendations that ideal match their threat monitoring demands.To understand the ins and outs of Livestock Danger Security (LRP) insurance policy completely, comprehending the aspects affecting LRP insurance policy premiums is vital. LRP insurance policy costs are determined by different components, consisting of the insurance coverage level picked, the expected price of animals at the end of the protection period, the kind of animals being guaranteed, and the size of the insurance coverage duration.Testimonial and Change Insurance Coverage Frequently: As market conditions transform, periodically review your LRP insurance coverage to guarantee it lines up with your current risk direct exposure.

Report this page